(Note, I am trying to make a joke here. In Chinese, 开心 literally means Open Heart. In most cases it means happiness or to open your full heart for joy and happiness! In this series Open Heart Happiness refer to my open-heart surgery process.)

My Open Heart Happiness has made me realize the importance of medical insurance.

The significant medical disputes in China are largely due to the absence or ineffective implementation of medical insurance. Direct financial transactions between doctors and patients inevitably lead to conflicts and also tarnish the professional ethics of doctors.

In fact, human nature is the same everywhere. Healthcare professionals in the United States also want to earn more money, but with the presence of insurance companies as a third party, squeezing extra money from patients becomes more complicated.

Firstly, for each illness, insurance companies estimate how much money is needed, how many days of hospitalization, and what kind of examinations are required. After the hospital and doctors have treated the patient, they submit a bill to the insurance company, detailing all the expenses.

After reviewing, the insurance company responds with how much they will pay for the illness and specific examinations. Doctors have contracts with insurance companies, if they want to accept this insurance, you must adhere to the prices set by the insurance company and cannot charge the patient more.

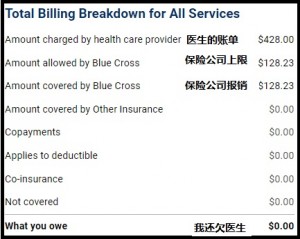

This is a bill from Blue Cross. The doctor’s fee is $428, but the insurance company says the maximum amount the Insurance will pays $128.23. If you don’t have insurance, you’ll have to pay the full $428; there’s no insurance company to negotiate the price for you.

But what if there are special circumstances during the treatment process that require a longer hospital stay? The attending physician must communicate with the insurance company first, and usually, the insurance company respects the doctor’s requests.

I wonder if this practice with Chinese characteristic would be handled differently, with a one-size-fits-all approach?

During my treatment process, I experienced intensive care, regular hospital ward, rehabilitation center, residential rehabilitation, and finally became an outpatient.

For the insurance company, each stage is cheaper than the previous one. But at each stage, the patient must meet certain criteria to move on.

It goes without saying for intensive care. After leaving the regular hospital ward, the patient probably won’t need emergency visits, consultations with multiple specialists, or immediate tests and scans.

Graduating from the rehabilitation center requires the patient to be able to take care of themselves, with a very low risk of falling after returning home. When the patient is capable of visiting outpatient clinics, residential services are no longer necessary.

For all the healthcare workers mentioned above, the only way to make more money from a patient is to keep him/her under their care for a longer period. It’s the insurance company, not the patient, who pays.

As mentioned earlier, for each illness, insurance companies have estimates: how long the hospital stay will be, how much it will cost altogether. So healthcare workers can only push to the insurance company’s limit.

When I was in the rehabilitation center, our department had an annual lunch. My colleagues joked, “Don’t worry, we will bust you out.”

I asked the nurse seriously if I could go out for lunch with my colleagues. She said, “We have no problem, but the insurance company may have doubts: if he can go out for lunch, why is he still staying in your rehabilitation center?”

For the livelihood of the medical staff in the rehabilitation center, I had to give up the annual lunch.

One insurance company only would lead to a monopoly. In the United States, there are many insurance companies, and they compete with each other, which ultimately benefits the insured (patients).

Insurance companies, doctors (hospitals), and patients (insured individuals) form a triad, and they check and balance each other.

Doctors recognize a particular insurance company because it has enough insured individuals, and the insurance company can provide sources of patients.

If you work for a large company, insurance companies hope that all your employees become insured with this insurance.

If you are a large hospital or a chain hospital, insurance companies would like all your hospital’s doctors to accept this insurance so that your insured individuals have more doctors to choose from.

Each of the three parties has its own bargaining chip!

Every year, there is a period when all three parties negotiate, reaching a price that all three parties can accept, and then the deal is made.

Everyone considers their own interests, and fair competition leads to harmony. This is the essence of a proper market economy.

But in China with special characteristic market economy, it doesn’t work because the government controls all resources, and everyone must serve the interests of the country/government/party. There is no possibility of fair competition. It’s such a simple staight-forward truth, some people just don’t understand it!

By the way, the so-called “world order” and “universal values” nowadays were realized by the people of the world after the disasters of two world wars. Why reinvent the wheel?

Back to medical insurance.

Our company uses a large insurance company. The advantage of getting insurance through an employer is that the employer pays part of the premium.

Our company offers two types of insurance: one requires a referral from your primary care physician to see a specialist, with a lower premium. The second allows you to directly see a specialist without a referral, as long as the doctor accepts this insurance.

In addition to the premium, there is also a concept of a deductible. Our company’s deductible is $500 for individuals, $1000 for couples, and I think it’s also $1000 for families.

This means you have to pay the first $500 of medical expenses each year, and the insurance company only pays for expenses exceeding that amount.

When I was in college, there was a health center on campus. At first, it was free, and students with or without illnesses would go there, partly to see the pretty nurses!

Later, they started charging a five-cent registration fee, and the pretty nurses were neglected.

This is similar to the deductible. If you think you won’t get sick this year, or if you haven’t been sick by the end of the year, you might as well not see a doctor this year and save $500.

But for the insurance company, this might save them a lot of money. Insurance companies hope that the insured individuals won’t get sick.

There is also a co-pay each time you visit an outpatient clinic, similar to a registration fee. Ours is $15. Hopefully, it’s not so much that people would avoid going to the doctor just to save $15!

How much did my surgery cost? I can’t escape the $500 annual deductible or the $15 copay each time I visit the outpatient clinic. The remaining cost is just for medication.

There are many private chain pharmacies in the United States. One I often use is called CVS. When the doctor prescribes medication, they send the prescription directly to the pharmacy you choose, and the pharmacy notifies you when the medication is ready for pickup.

I haven’t researched whether pharmacies, insurance companies, and insured individuals also have this “three-party check and balance” model. But usually, your medical insurance and prescription insurance are from the same insurance company.

Each medication has an original price, and the insurance company applies discounts before you pay for the medication. Usually, you don’t need to worry about the original price of the medication.

One function of the pharmacy is to verify that the dosage prescribed by the doctor is appropriate. If there are any questions, they directly contact the doctor, so the patient doesn’t need to intervene since they usually don’t understand these matters.

When new drugs hit the market, their prices are often high, as a return on the research and development investment. After a few years, when the patent expires, other companies mimic the formula and produce generic versions with the same effect.

Pharmacies act as gatekeepers; they never provide brand-name drugs when generic options are available. This serves both the insured individuals and the insurance companies by saving costs. Generic drugs have the same effectiveness and are regulated by the national drug administration.

There may be occasions where brand-name drugs are necessary. In such cases, the prescribing doctor must communicate with the insurance company.

When Viagra (a medication for male impotence) first came out, four pills cost $50, even after insurance discounts. Now, with the availability of generic versions, four pills cost less than $2.

Pharmacies must be diligent and maintain standards. Otherwise, insurance companies can opt not to work with them, and patients can choose other pharmacies. This reflects the mechanism of a market economy!

Preventive medicine is widespread. For insurance companies, the cost of prevention is much lower than that of treatment or emergency care. Some insurance companies prioritize preventive medicine and even reimburse the cost of exercise.

Speaking of my heart rehabilitation, it’s also a form of preventive medicine—preventing a recurrence of the same problems.

The insurance company covered 16 rehabilitation sessions, twice a week for eight weeks, each lasting two to three hours. The first hour involved exercise on various equipments, with nurses monitoring my heart continuously, somewhat resembling my initial dynamic electrocardiogram.

Perhaps all of us who have undergone heart surgery can be considered to have been reborn. The second hour was a seminar on “How to Adapt to Your New Life.” Each seminar was different, covering topics like exercising at home or nutrition.

What mattered most to me was taking things easy and not overexerting myself, especially not shevel the snow since low temperatures could strain the heart.

Luckily, Boston didn’t see much snow this year; even when it did snow, it quickly turned to rain. No shoveling needed, and that was a blessing!

This reminded me of a passage from Liu Xinwu’s novel “The Position of Love.”

Looking at the snowflakes falling outside the window, the teacher recited, “Snow falls from the heavens but turns into rain upon touching the ground. It’s more troublesome when it turns into rain; it would have been better if it had just rained from the beginning!”

The student interjected, “Teacher eats grains not …”

March 24, 2023 Boston